ClearstreamXact: Enhanced Tax functionality in Xact Web Portal – Update

Note: This announcement, originally published on 24 October 2022 and updated on 14 June 2023, 30 November 2023 and 22 January 2024, has been further amended to include additional information on the enhanced functionality. Changes have been highlighted.

Further to Announcements A23087 (Sweden) and A23088 (Norway), LuxCSD1 informs clients about tax handling enhancements via a new functionality in Xact Web Portal, effective

1 July 2024

Background

Xact Web Portal has been enhanced to provide clients with an extended tax functionality to improve tax and corporate actions users experience.

Enhanced functionality

The following changes will be available:

a) An improved Tax Dashboard in Xact Web Portal: “My Indicators” will be enhanced with a new “Tax” menu, the “Asset Servicing” menu will be further enhanced with “Taxable Events close to Payment”, and a "New WTRC Requests” widget will be added under "Message Exchange" for better monitoring;

b) New Pro-active push of information to clients;

c) The status of "Tax Certificates" will be updated every 15 minutes instead of once per day;

d) Upgrades to domains and sub-domains under Tax Service:

- New domain “Tax Attestation”:

- New sub-domain “Tax Attestation Query”;

- New sub-domain “Tax Attestation Request Upload”;

- The existing domain “Beneficial Owner” is renamed to “Instruction”:

- New sub-domain “BO Allocation Upload";

- Existing sub-domain “Upload” is renamed to “BO List Web Upload”;

e) Certification request announcements with enhanced narrative;

f) Event search using the “IRS Income Code” (U.S.);

g) Quick refund via formatted instructions;

h) Beneficial Owner Disclosure in straight-through processing for Germany, Finland, Norway and Sweden;

i) Tax attestation requests (German tax vouchers) and status management available via Xact Web Portal and Xact File Transfer.

Xact Web Portal

Dashboard/My Indicators

U.S. Tax Announcements Dashboard alerts (U.S.)

Clients will be able to see when new Tax Certification messages have been received in Xact Web Portal:

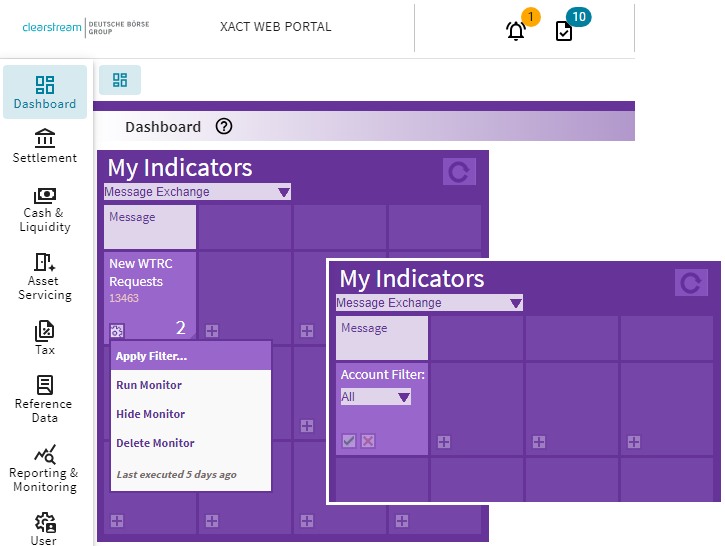

- In the Dashboard, a "New WTRC Requests” widget will be added under «Message Exchange» in My Indicators.

- Clicking on the widget will indicate the number of requests that can be filtered by account and take the user directly to the Message Exchange2 domain where a predefined query "New WTRC Requests" will be added with the following filters:

- "Tax WTRC - request";

- Received Timestamp From/To ranging from current date minus 28 calendar days to current date;

- Folder = New.

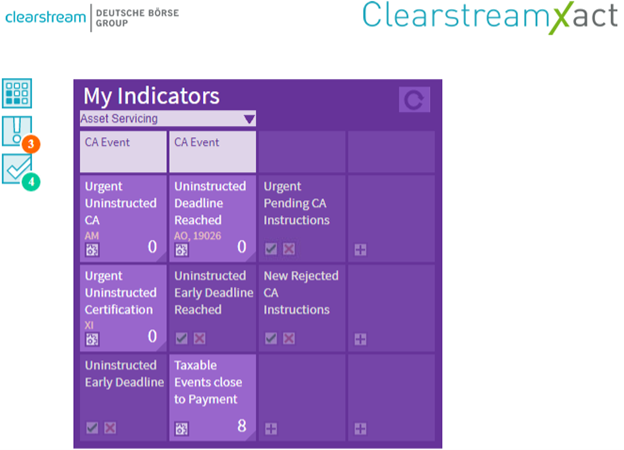

A new Tax item under “My Indicators” is now available from the drop-down menu.

This widget provides clients with information about which action has to be taken for Tax Certificates:

- Certificates close to Expiry;

- Rejected Tax Certificates;

- Tax Attestations to Download;

- Rejected Tax Attestations;

- Cancelled Tax Attestations.

The “Asset Servicing” menu has been enhanced with “Taxable Events close to Payment” displaying events with a payment under 2 business days.

Tax/Tax Attestation3

1. Tax Attestation Query

The tax attestation query is used to query German Tax Vouchers (will be extended to further markets in the future).

To query Tax Attestation

1. In the main menu, select Tax, Tax Attestation, Tax Attestation Query.

2. In the Query view, the following details can be selected:

- File upload ID;

- Attestation ID;

- Status;

- Attestation Type;

- Corporate Action Ref.;

- BO Identification ID;

- Safekeeping Account;

- Financial Instrument;

- Quantity;

- Date;

- Source;

- Last Update Timestamp.

2. Tax Attestation Request Upload

Tax Attestation Request Upload is used to request German Tax Vouchers (will be extended to further markets in the future).

To create a Tax Attestation Request

- In the main menu, select Tax, Tax Attestation, Tax Attestation Request Upload;

- The Create tab opens. Under File Content, select "German Tax Voucher Request (CSV)" from the drop-down list.

The button “Download…” in the bottom right corner of the screen allows you to download the template (.xls) for the German Tax Voucher Request which you can fill out with the necessary details; - Once the template has been completed, click on the “Create CSV request file” button to generate a corresponding CSV file which will be stored in the same folder as where the template was downloaded (procedure explained in the template itself);

- From the Tax Attestation Request Upload/Create screen in Xact Web Portal, click on “Upload File” and browse for the CSV file to be uploaded;

- Click on “Submit” to upload and send the file.

To query Tax Attestation Request Upload

1. In the main menu, select Tax, Tax Attestation, Tax Attestation Request Upload. Click on the Query/List tab.

2. In the Query view, the following details can be selected:

- File content (German Tax Voucher Request (CSV);

- File upload ID;

- User ID;

- File name;

- File status;

- Date uploaded;

- Source;

- STP mode.

Tax/Instruction

1. BO Allocation Upload

BO Allocation Upload is used to provide Clearstream Banking4 with Beneficial Ownership information.

How to create a BO Allocation Upload

- In the main menu, select Tax, Instruction, BO Allocation Upload;

- The Create tab opens. Under File Content, select "Corporate action instructions (CSV)" from the drop-down list.

- The button “Download…” in the bottom right corner of the screen allows you to download the template (.xls) for Corporate action instructions containing a dedicated “Tax Instructions Data” tab which you can fill out with the necessary details;

- Once the template has been completed, click on the “Create Instruction file” button to generate a corresponding CSV file which will be stored in the same folder as where the template was downloaded (procedure explained in the template itself);

- From the BO Allocation Upload/Create screen in Xact Web Portal, click on “Upload File” and browse for the CSV file to be uploaded;

- Click on “Submit” to upload and send the file.

2. BO List Web Upload

Clicking on "BO List Web Upload" will lead users to the existing upload functionality on Clearstream Banking's website.

Certification request announcements with enhanced narrative

Tax narratives previously sent to clients via a separate Withholding Tax Relief Certification (WTRC) will now be integrated into the income event notification. As a result, these WTRCs will no longer be sent.

The change will apply for the following markets: Australia, Bulgaria, Canada, Chile, Czech Republic, Estonia, Finland, France, Hungary, Iceland, Ireland, Israel, Italy, Japan, Korea, Latvia, Luxembourg, Malta, New Zealand, Norway, Poland, Portugal, Romania, Slovakia, South Africa, Spain, Sweden, Switzerland, Depository Receipts and Eurobonds.

The improvement will be available for taxable events where Clearstream Banking offers relief at source and occasionally quick refund tax services.3

Please note that a WTRC continues to be used for the announcement of tax events with an underlying corporate action event (DVOP, DRIP, DVCA CHOS, ACCU, SOFF etc.)

Event search using the “IRS Income Code” (U.S.)

It will be possible to search events in Xact Web Portal by using the new “IRS Income Code” drop-down list in the following queries:

Asset Servicing / Event / CA Event Query

- New “IRS Income Code” drop-down list under “Search By CA Events”;

- Enabled only if no “Market” is selected or “US – UNITED STATES OF AMERICA” is selected.

Asset Servicing / Confirmation / CA Confirmation Query

- New "IRS Income Code" drop-down list under "Search By Movement".

Quick refund via formatted instructions

Instructing via MT565 and Xact Web Portal CA Instruction for quick refund, where the service is offered, is available as of the effective date.

Beneficial owner disclosure in straight-through processing for Germany, Finland, Norway and Sweden

A new possibility to run preliminary certification checks on selected Beneficial Owners will be introduced. It will be found under Asset Servicing / Instruction / CA Instruction / Create CA Instruction / Beneficial owner details / Add:

1. Optional pre-validation check via Party Lookup for TIN and Name and Address (BO Lookup window)

Populate the relevant fields and click on the “Pre-validation” check mark as shown below:

The resulting “Pre-validation Feedback” status will then appear as shown below:

2. New pre-validation button

Alternatively, if the BO Lookup was done without using the pre-validation check, or if the BO Lookup was not used at all, then a BO list pre-validation check is still possible by clicking on the “Pre-validation” button:

Xact File Transfer

Clients who have access to Xact File Transfer (CDIRECT/CreationDirect) will be able to upload their Tax Attestation Requests, using the German Tax Voucher Request template that can be downloaded from Xact Web Portal as explained above under point 2. Tax Attestation Request Upload.

Alternatively, for clients who do not have access to Xact Web Portal, the template can be downloaded from the website under Tax forms to use - Germany.

Once filled in, the template can be used to generate a CSV file to be uploaded to the Xact File Transfer filestore to be processed by Clearstream Banking.

After sending a valid or validated German Tax Voucher Request via Xact File Transfer, clients will be able to retrieve their tax vouchers from the “Reports” folder in the filestore (After two weeks the tax vouchers will be archived. Access will only be possible upon submitting the corresponding Request ID via the same template under tab ”Download&Cancellation Requests”).

Further information on the File Upload functionality can be found in the Xact Web Portal User Manual.

Further information on Xact File Transfer can be found in the Xact File Transfer via Internet - User Guide or the Xact Web Portal User Manual.

Further information

Please see the Clearstream website for more information about Xact Web Portal.

For further information, please contact the Clearstream Connectivity Helpdesk or your Relationship Manager.

------------------------------------------

1. LuxCSD refers to LuxCSD S.A., registered office at 42, Avenue J.F. Kennedy, L-1855 Luxembourg, registered with the Luxembourg Trade and Companies Register under number B-154.449.

2. On an exceptional basis, a Withholding Tax Relief Certification (WTRC) event notification, together with an income event notification, may still be required.

3. Access to the Tax Attestation Query and Tax Attestation Request Upload will be granted at OU level for existing Tax users, in which case admin users will need to grant access to end users. Clients currently not having access to the Tax service will need to send an access request to the PRGconnect team via Swift MT599 or Xact Web Portal Message Exchange.

4. Clearstream Banking refers collectively to Clearstream Banking S.A., registered office at 42, avenue John F. Kennedy, L-1855 Luxembourg, and registered with the Luxembourg Trade and Companies Register under number B-9248, and Clearstream Banking AG, registered office at 61, Mergenthalerallee, 65760 Eschborn, Germany and registered in Register B of the Amtsgericht Frankfurt am Main, Germany under number HRB 7500.